why are reits tax efficient

Find out why tax-efficient investing is important and how it can save you money. Theres another reason to put REITs in tax-advantaged accounts.

Sec 199a And Subchapter M Rics Vs Reits

REIT Returns vs.

. Their comparatively low correlation with other assets also. Further REITs recently became even more tax efficient under the new 2017 Tax and Jobs Cuts Act. The reason is that a growing economy increases the.

Shareholders may then enjoy preferential US. Rentals Limit You to One Market. Tax rates on dividend distributions from the REIT.

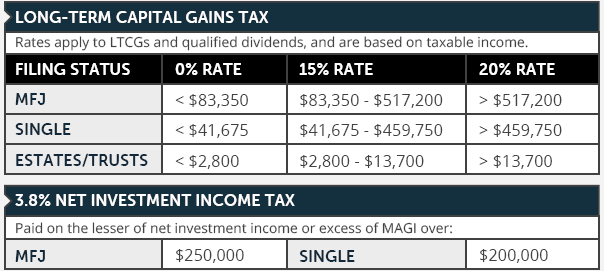

While REITs are less tax efficient than qualified dividend-paying US equities the extent of their inefficiency is overstated and misunderstood. Long-term capital gains are taxed at lower. Potential Market Inefficiency Due to the weird legal structure of.

In exchange for paying out at least 90 of taxable income to shareholders REITs. The Tax Cuts and Jobs Act TCJA passed into law in 2017 further enhanced the tax efficiency. REITs Are A Tax Headache.

Ad Now You Can Use Fundrise Reits To Diversify The Way Successful Institutions Do. Most private real estate investors are buy and hold investors. When looking at after-tax total returns the effective tax rate gap between REITs and corporates is typically much closer than generally perceived.

Taxes are always a headache. REIT dividends are usually not considered qualified so they are taxed at whatever your marginal tax rate happens to be. This occurs when a REIT sells a property that it has owned for over a year and chose to distribute that income to shareholders.

But REITs are no more so than a typical dividend-paying stock. Reduce Correlation Volatility And Risk By Investing In Premium Tech-driven Reits. For this reason I recommend you hold your REITs in an.

While REITs may experience. Reduce Correlation Volatility And Risk By Investing In Premium Tech-driven Reits. Tax-efficient investing can minimize your tax burden and maximize your returns.

Get your free copy of The Definitive Guide to Retirement Income. Their dividend tax rate is much higher than dividends on stocks. During periods of economic growth REIT prices tend to rise along with interest rates.

Ad Now You Can Use Fundrise Reits To Diversify The Way Successful Institutions Do. Tax Efficiency By holding a REIT in my Roth I can lower my tax rate on REIT income from 24 to 0. REITs pay out roughly 65 of their distributions.

An analysis of Burton G. Starting in tax year 2018 an additional benefit has been added to REITs thanks to tax reform. Real Estate Investment Trusts REITs are known as a tax efficient way to invest in real estate.

REITs historically have delivered competitive total returns based on high steady dividend income and long-term capital appreciation. REITs Can Enter Real Estate Related Businesses to Boost Returns. A REIT is a tax-efficient vehicle that gives people exposure to a diversified portfolio of income producing properties.

Rather than having to buy and maintain actual physical real estate properties investors can. Theres another reason to put REITs in tax-advantaged accounts. REITs are a tax-efficient diversified alternative to direct real estate ownership and investment.

This section of the article examines why funds use REITs for the benefit of foreign investors how various types. They both report distributions at the end. Ad Learn the basics of REITs before you invest any of your 500K retirement savings.

When you take all of that into account I actually pay less taxes investing in REITs and it is also a lot easier and more time-efficient. It can be a way for you to invest less capital so that in 5 10 or 15 years. The bill featured a new 20 percent tax deduction for pass-through entities.

The 542 of my dividends that are qualified REIT dividends will now be 20. They buy the property collect the.

5 Tax Sheltered Investments That You Didn T Know About Investing Business Bank Account Online Business Opportunities

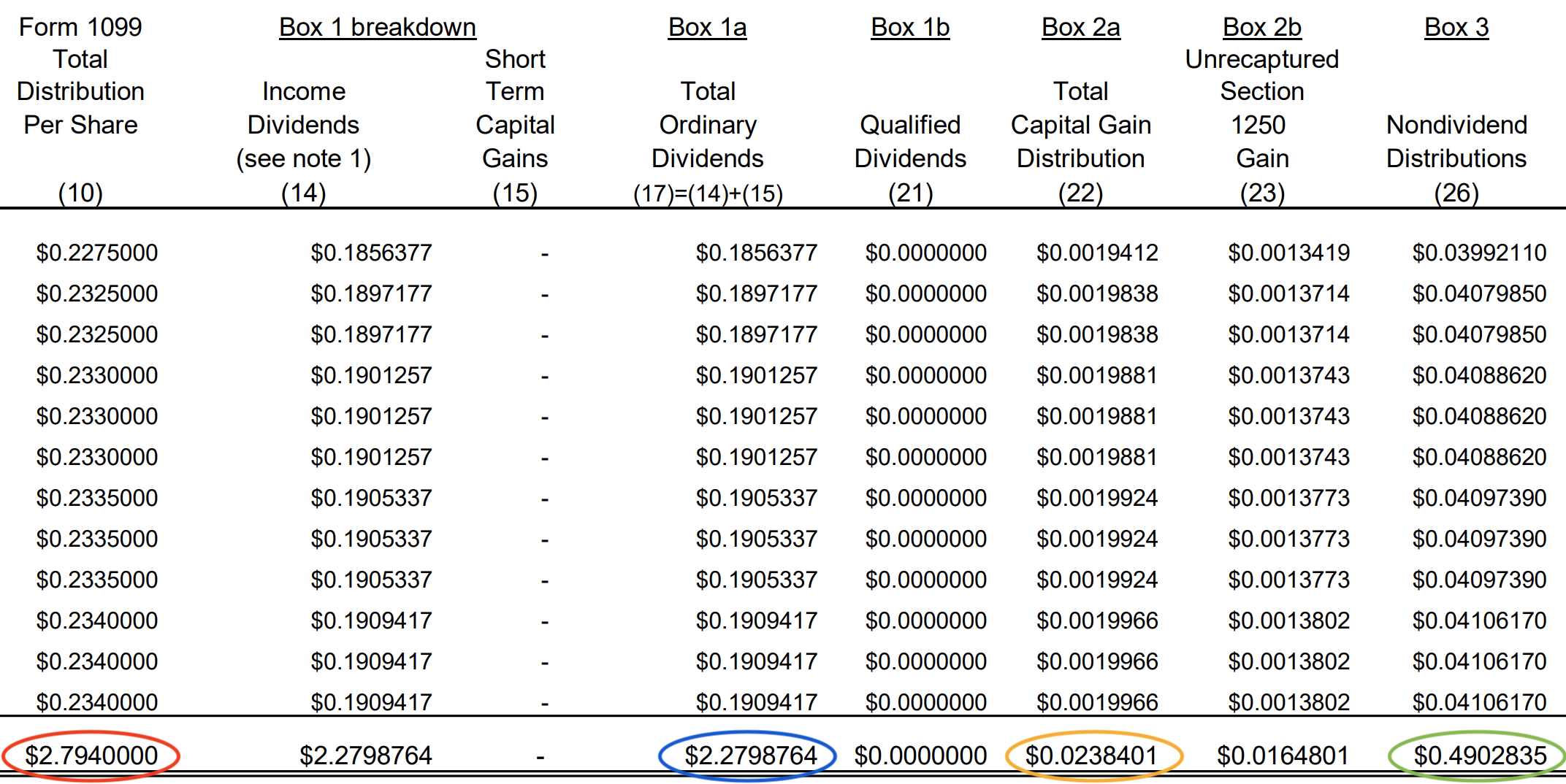

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

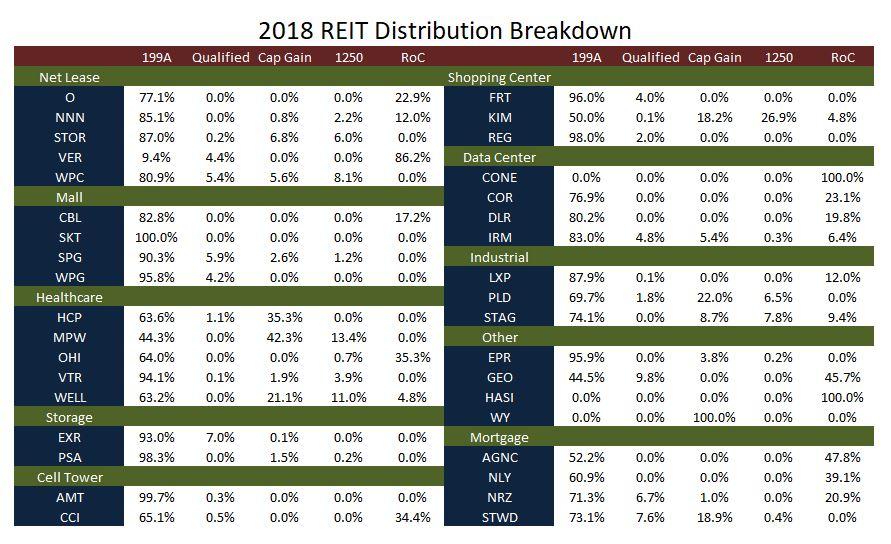

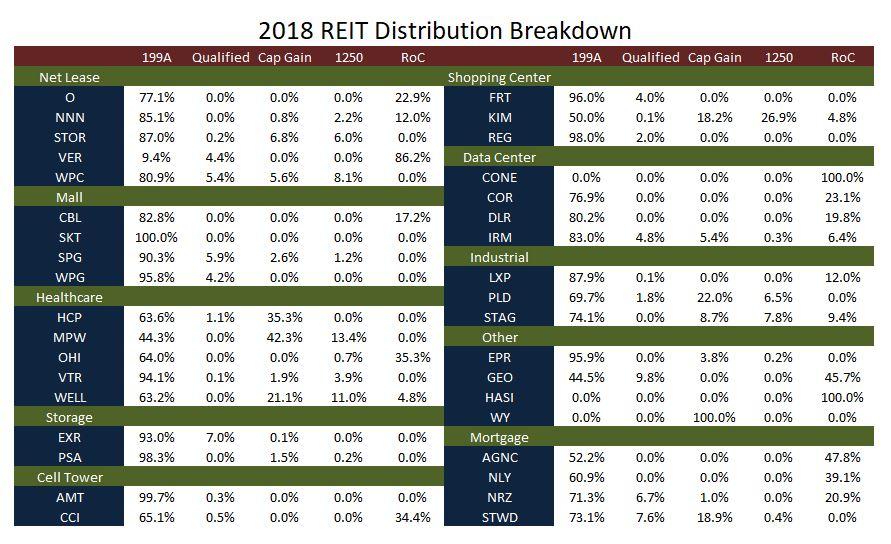

How Tax Efficient Are Your Reits Seeking Alpha

Valuist Top 5 Ways To Use Loyalty Rewards Loyalty Rewards Loyalty Rewards Program Rewards Credit Cards

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

According To Case Shiller Us Housing Has Paused On Its Way Down Marketing Set Housing Market Marketing

Ashok Mohanani Chairman Ekta World Mumbai News Quikrhomes 4 Words New World Word Search Puzzle

How To Assess A Real Estate Investment Trust Reit Using Ffo Affo Real Estate Investment Trust Investing Real Estate Investing

Guide To Reits Reit Tax Advantages More

Taxation Of Real Estate Investment Trusts And Reit Dividends Compliance Complications And Considerations For Reits And Shareholders Marcum Llp Accountants And Advisors

5 Tax Planning Fundamentals For Investors Investing Investing Strategy Tax

How To Build A Tax Efficient Taxable Account As A Physician Wealthkeel Advisors Llc

Tax Lien Investing Simple Diy Investing For 18 Returns Diy Investing Investing Real Estate Investing

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

/dotdash_Final_How_to_Assess_a_Real_Estate_Investment_Trust_REIT_Nov_2020-01-d11e2a73dcd74c80b629e0f3068f85d8.jpg)

How To Assess A Real Estate Investment Trust Reit Using Ffo Affo

Guide To Reits Reit Tax Advantages More

Presidential Tax Rate Proposal Mullin Barens Sanford Financial

Rental Properties For Passive Income 5 Things I Wish I Would Have Known Fir Real Estate Investing Rental Property Real Estate Education Real Estate Investing